Summer 2019

Whether you’ve been investing for decades or are just getting started, at some point on your investment journey you’ll want to ask yourself some of the questions below.

Answering these questions may be intimidating, but know that we are here to help. While this is not intended to be an exhaustive assessment, it will hopefully shed light on a few key data- and reason-based principles that may help improve your odds of investment success in the long run.

1. What sort of competition do I face as an investor?

The market is an effective information-processing machine. Millions of market participants buy and sell securities every day, and the real-time information they bring helps set prices.

This means competition is stiff and trying to outguess market prices is difficult for anyone, even professional money managers (see question 2 for more on this). Which is good news for investors. Rather than basing an investment strategy on trying to find securities that are priced “incorrectly,” investors can instead rely on the information in market prices to help build their portfolios (see question 5 for more on this).

In USD. Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. ETFs and funds are excluded. Daily averages were computed by calculating the trading volume of each stock daily as the closing price multiplied by shares traded that day. All such trading volume is summed up and divided by 252 as an approximate number of annual trading days.

2. What are my chances of picking an investment fund that survives and outperforms?

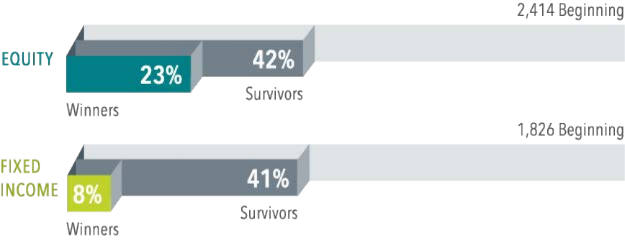

Flip a coin and your odds of getting heads or tails are 50/50. Historically, the odds of selecting an investment fund that will be around 20 years later are about the same. Regarding outperformance, the odds are worse. The market’s pricing power works against fund managers who try to outperform through stock picking or market timing. One needn’t look further than real-world results to see this. Only 23% of U.S. equity mutual funds and 8% of fixed income funds have survived and outperformed their benchmarks over the past 20 years (see Note A).

Note A: Source: *Mutual Fund Landscape 2019, Dimensional Fund Advisors. See Appendix for important details on the study. Past performance is no guarantee of future results.

3. If I choose a fund because of strong past performance, does that mean it will do well in the future?

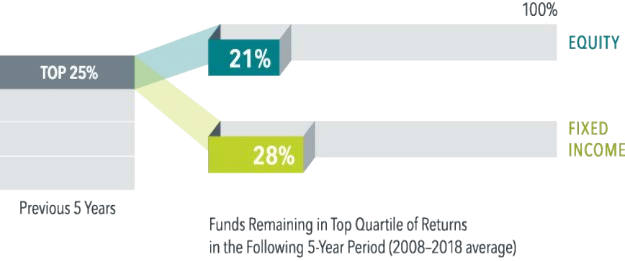

Some investors select mutual funds based on past returns. However, research shows that most funds in the top quartile (25%) of previous five-year returns did not maintain a top-quartile ranking in the following five years. In other words, past performance offers little insight into a fund’s future returns.

Source: Mutual Fund Landscape 2019, Dimensional Fund Advisors. See Appendix for important details on the study. Past performance is no guarantee of future results.

4. Do I have to outsmart the market to be a successful investor?

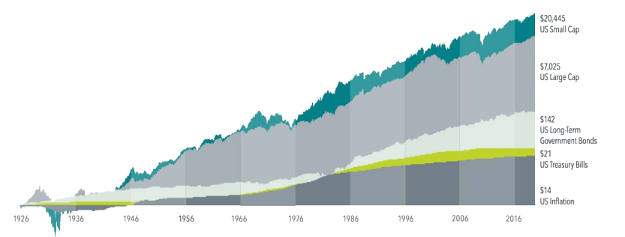

Financial markets have rewarded long-term investors. People expect a positive return on the capital they invest, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation. Instead of fighting markets, let them work for you.

In USD. US Small Cap is the CRSP 6–10 Index. US Large Cap is the S&P 500 Index. Long-Term Government Bonds is the IA SBBI US LT Govt TR USD. Treasury Bills is the IA SBBI US 30 Day TBill TR USD. US Inflation is measured as changes in the US Consumer Price Index. CRSP data is provided by the Center for Research in Security Prices, University of Chicago. S&P data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Long-term government bonds and Treasury bills data provided by Ibbotson Associates via Morningstar Direct. US Consumer Price Index data is provided by the US Department of Labor Bureau of Labor Statistics.

5. Is there a better way to build a portfolio?

Academic research has identified equity and fixed income dimensions as shown below. These dimensions attempt to explain differences in expected returns among securities. Instead of trying to outguess market prices, investors can instead pursue higher expected returns by structuring their portfolio around these dimensions.

Relative price is measured by the price-to-book ratio; value stocks are those with lower price-to-book ratios. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book.

6. Is international investing for me?

Diversification helps reduce the risk that the performance of any one security can have on your portfolio, but diversifying only within your home market may not be enough. Instead, global diversification can broaden your investment opportunity set. By holding a globally diversified portfolio, investors are well positioned to seek returns wherever they occur.

Number of holdings and countries for the S&P 500 Index and MSCI ACWI (All Country World Index) Investable Market Index (IMI) as of December 31, 2018. S&P data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. MSCI data © MSCI 2019, all rights reserved. International investing involves special risks, such as currency fluctuation and political instability. Investing in emerging markets may accentuate these risks. Investing in emerging markets may accentuate those risks. Diversification does not eliminate the risk of market loss. Indices are not available for direct investment.

7. Will making frequent changes to my portfolio help me achieve investment success?

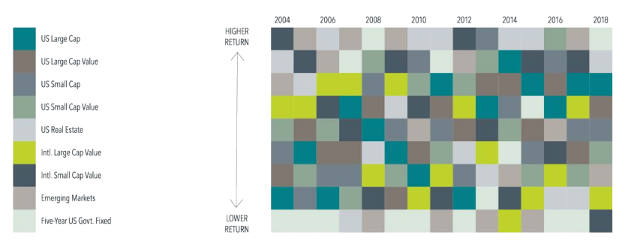

It’s tough, if not impossible, to know which market segments will outperform day to day and year to year.

It’s better to avoid market timing calls and other unnecessary changes that can be costly. Allowing emotions or opinions about short-term market conditions to impact long-term investment decisions can lead to disappointing results.

In USD. US Large Cap is the S&P 500 Index. US Large Cap Value is the Russell 1000 Value Index. US Small Cap is the Russell 2000 Index. US Small Cap Value is the Russell 2000 Value Index. US Real Estate is the Dow Jones US Select REIT Index. International Large Cap Value is the MSCI World ex USA Value Index (gross dividends). International Small Cap Value is the MSCI World ex USA Small Cap Value Index (gross dividends). Emerging Markets is the MSCI Emerging Markets Index (gross dividends). Five-Year US Government Fixed is the Bloomberg Barclays US TIPS Index 1–5 Years. S&P and Dow Jones data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2019, all rights reserved. Bloomberg Barclays data provided by Bloomberg. Chart is for illustrative purposes only.

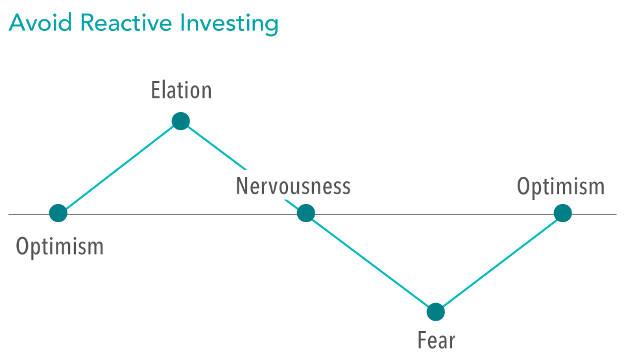

8. Can my emotions affect my investment decisions?

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to poor investment decisions.

9. Should I make changes to my portfolio based on what I’m hearing in the news?

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. If headlines are unsettling, consider the source and try to maintain a long-term perspective.

10. So, what should I be doing?

Rely on a trusted financial advisor who can offer expertise and guidance to help you focus on actions that add value. Focusing on what you can control can lead to a better investment experience—and achieving your goals.

We believe the following are crucial components of any investment plan:

- Create an investment plan to fit your needs and risk tolerance.

- Structure a portfolio along the dimensions of expected returns.

- Diversify globally.

- Manage expenses, turnover, and taxes.

- Stay disciplined through market dips and swings.

APPENDIX

Question 2: The sample includes funds at the beginning of the 20-year period ending December 31, 2018. Each fund is evaluated relative to its respective primary prospectus benchmark as of the end of the evaluation period. Surviving funds are those with return observations for every month of the sample period. Winner funds are those that survived and whose cumulative net return over the period exceeded that of their respective primary prospectus benchmark. Loser funds are funds that did not survive the period or whose cumulative net return did not exceed that of their respective primary prospectus benchmark. Where the full series of primary prospectus benchmark returns is unavailable, funds are instead evaluated relative to the Morningstar category index assigned to the fund’s category at the start of the evaluation period.

Question 3: This study evaluated fund performance persistence over rolling periods from 1999 through 2018. Each year, funds are sorted within their category based on their previous five-year total return. Those ranked in the top quartile (25%) of returns are evaluated over the following five-year period. The chart shows the average percentage of top-ranked equity and fixed income funds that kept their top ranking in the subsequent period.

Questions 2 and 3: US-domiciled open-end mutual fund data is from Morningstar. Equity fund sample includes the Morningstar historical categories: Diversified Emerging Markets, Europe Stock, Foreign Large Blend, Foreign Large Growth, Foreign Large Value, Foreign Small/Mid Blend, Foreign Small/Mid Growth, Foreign Small/Mid Value, Global Real Estate, Japan Stock, Large Blend, Large Growth, Large Value, Mid-Cap Blend, Mid-Cap Growth, Mid-Cap Value, Miscellaneous Region, Pacific/Asia ex-Japan Stock, Real Estate, Small Blend, Small Growth, Small Value, World Large Stock, and World Small/Mid Stock. Fixed income fund sample includes the Morningstar historical categories: Corporate Bond, High Yield Bond, Inflation-Protected Bond, Intermediate Government, Intermediate-Term Bond, Long Government, Muni California Intermediate, Muni California Long, Muni Massachusetts, Muni Minnesota, Muni National Intermediate, Muni National Long, Muni National Short, Muni New Jersey, Muni New York Intermediate, Muni New York Long, Muni Ohio, Muni Pennsylvania, Muni Single State Intermediate, Muni Single State Long, Muni Single State Short, Short Government, Short-Term Bond, Ultrashort Bond, and World Bond. See Dimensional’s Mutual Fund Landscape 2019 for more detail. Index data provided by Bloomberg Barclays, MSCI, Russell, FTSE Fixed Income LLC, and S&P Dow Jones Indices LLC. Bloomberg Barclays data provided by Bloomberg. MSCI data © MSCI 2019, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. FTSE fixed income indices © 2019 FTSE Fixed Income LLC. All rights reserved. S&P data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.