As comprehensive wealth and tax planning professionals, we help you get a handle on your entire financial life. What makes us unique is our expertise in equity award planning and in-depth tax matters, along with our individualized approach. We go far beyond asset management into big picture stuff, like values, relationships, and lifelong dreams.

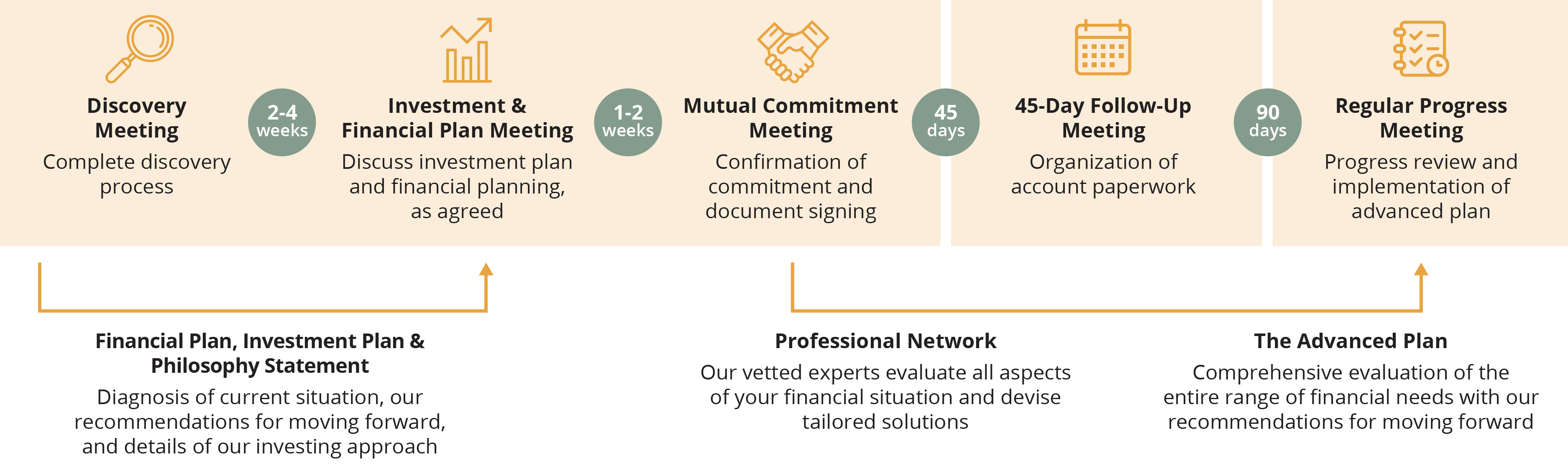

Through ongoing personal contact—via email, phone, or in-person meetings—our clients receive professional, customized, accountable financial guidance, tax planning, and investment management. Managing risk through insurance planning is also part of the discussion. Our clients can expect quarterly performance reports and face-to-face annual reviews.

All clients receive ongoing financial planning. With this service, we help you preserve your assets by taking appropriate risk with your investments, minimizing income taxes, and protecting what you’ve worked hard to accumulate. Long-term goals and short-term needs are all part of the equation. As your situation changes, or if you want to consider new possibilities for the future, we can quickly incorporate those changes into your plan.

Financial independence analysis includes finding the date you no longer need to work, and then implementing and monitoring your plan. It also includes maximizing employer benefits, such as deferred compensation plans and tax-deferred plans like 401(k)s. If you are self-employed, we can help you make the most of other tax-mitigation strategies and retirement savings vehicles.

Insurance planning—also known as risk management—can help protect your assets from a catastrophic loss. You don’t want too much insurance or too little. But you do want to cover loss of income or large expenses from events that could harm your health or wipe out your savings.

For entrepreneurs, preservation of wealth after an IPO, acquisition, merger, or other liquidity event is a huge challenge. And employees can spend entire workdays trying to make sense of stock options, ESPPs, RSUs, and other valuable but often mystifying equity awards.

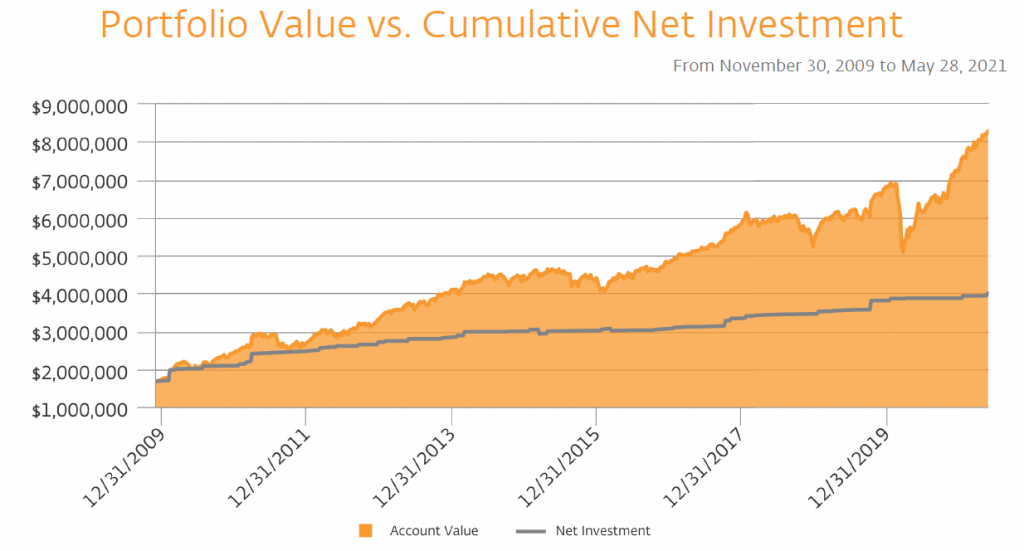

Our clients gladly delegate the implementation and monitoring of their investment portfolios to us. In return, they save time and receive rational, disciplined, fiduciary guidance to make smart financial decisions.

We manage the day-to-day activity in our clients’ portfolios, keeping asset allocations in line with objectives and a sharp eye on the tax consequences of our actions. For example, we only sell a holding if we believe the benefit outweighs the tax cost.

We design globally diversified portfolios that use a primarily passive approach with enhanced index mutual funds and tax-managed ETFs. On the fixed income side, we use actively managed bond funds when we believe the manager can add substantial value. We carefully select all the funds we use based upon in-depth research of asset classes, tax efficiency, and low expense ratios.

Dimensional Fund Advisors provides the foundation of our client asset allocation. Dimensional’s investment approach—which largely mirrors our own, though we do use non-Dimensional funds, as well—is based on a belief that the market is an effective information-processing machine. The market’s real-time pricing power works against active mutual fund managers who attempt to use stock picking or market timing to outperform it. Rather than trying to predict the future or outguess others, Dimensional draws information about expected returns from the market itself, taking into account the collective knowledge of millions of buyers and sellers as they trade securities.

Grounded in economic theory and backed by decades of empirical research, Dimensional researchers work closely with leading economists to better understand the source of returns. Securities offering higher expected returns share certain characteristics, or dimensions. Our team structures broadly diversified portfolios that emphasize these dimensions, while strategizing the execution to minimize trading costs. Every incremental improvement can add up over time.

A successful investment experience is about more than just returns. It means offering peace of mind, because investors know that a transparent process backed by decades of research is powering every decision.

At JLFranklin Wealth Planning, we’ve seen the difference this approach has made in people’s lives. Our goal is to help people live better—not just years from now, but today, too.

Charles Schwab & Co. is the custodian of our clients’ assets.

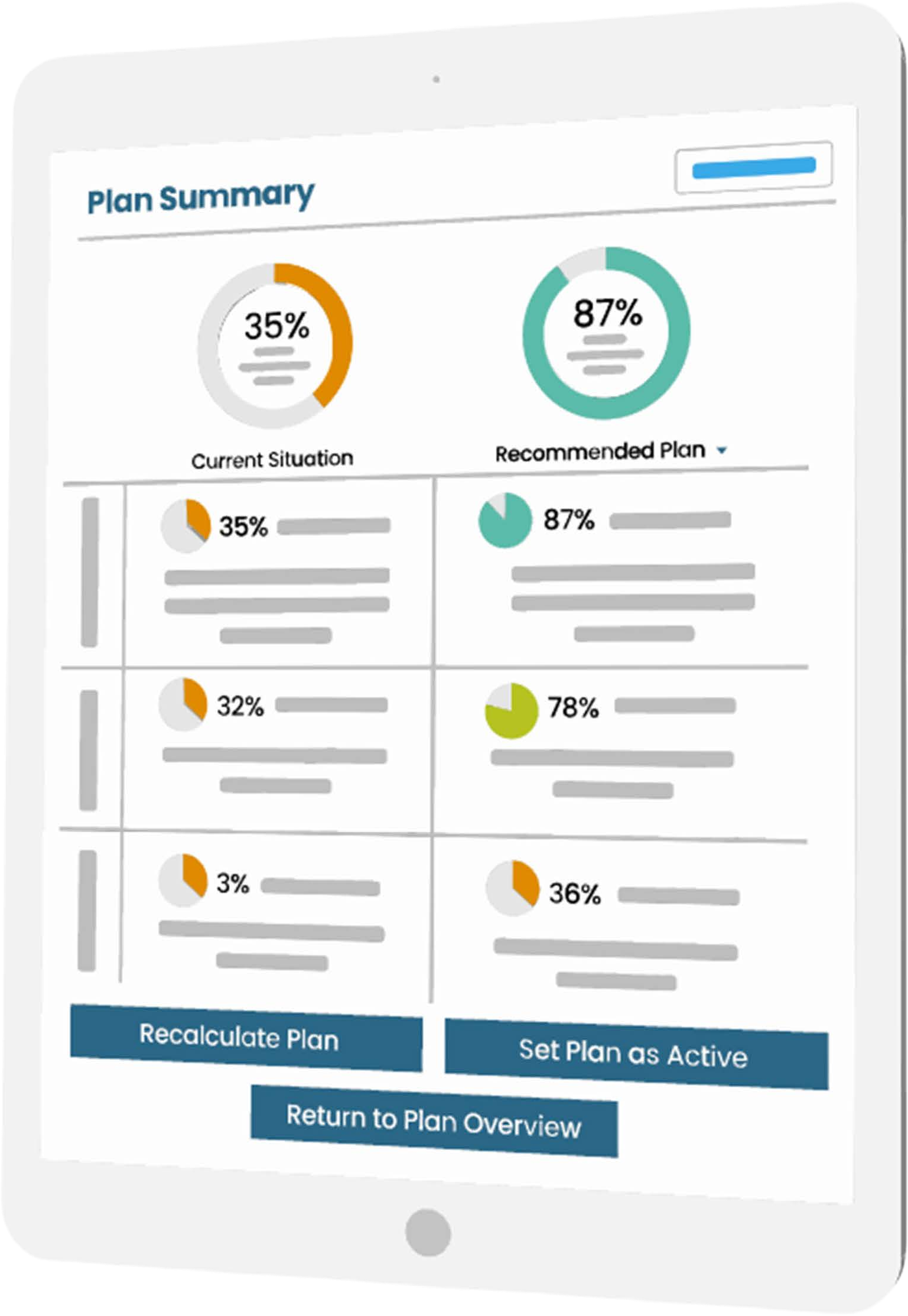

Our judicious 5-step process reveals each client’s unique concerns and needs. The foundation of our approach is our ability to uncover the entire financial picture, going far beyond asset management or estate planning into our clients’ most important values, relationships, and lifelong dreams. This process retains our objectivity and integrity and provides you with straightforward, customized, actionable advice.

Our ideal investment management client has a minimum of $2 million in assets available for management. If you have less than $2 million but are sitting on an equivalent amount of vested options or other equity awards, let’s talk.

We deduct investment advisory fees from your account on a quarterly basis.

|

Value of All Managed Accounts with Us

|

Fee Per Qtr

|

Annualized

|

|---|---|---|

|

First $2 million

|

0.250%

|

1.00%

|

|

Next $3 million (up to $5 million)

|

0.200%

|

0.80%

|

|

Next $5 million (up to $10 million)

|

0.175%

|

0.70%

|

|

Next $15 million (up to $25 million)

|

0.150%

|

0.60%

|

|

More than $25 million

|

0.125%

|

0.50%

|

Our minimum quarterly investment advisory fee is $5,000.

For entrepreneurs and employees, preservation of wealth after an IPO, acquisition, or merger is a huge challenge. We can help you make sense of stock options, ESPPs, RSUs, and other valuable equity awards.

What sets human resources professionals apart is that you really understand the importance of financial planning. You just don’t always do it.

Based on our 20 years of experience working with executives and individual contributors at Google, we know that the key to a successful future is to plan accordingly and take timely action with GSUs and other Alphabet benefits.

Sign up for our newsletter and get actionable info you can use today, and in the future.

"*" indicates required fields

©2024 JLFranklin Wealth Planning